What Is Gator Lending in 2026? How to Get Smart With This Creative Financing Method

What is gator lending in 2026? It’s the kind of question investors only ask when the market stops playing nice – and lately, it hasn’t been.

Deals are collapsing because lenders are moving slowly, and earnest money expectations in competitive metro markets keep inching upward. This is the “move fast or miss out” era of commercial real estate.

That pressure is exactly why gator lending has resurfaced as a practical tool rather than a trend pulled from social media. It’s fast becoming a financing method built for investors who need to act before traditional capital catches up.

In 2026, it’s a solid way to secure a property, beat competing bids, and control the deal while others are still waiting on approvals.

In this article, we’ll cover the following:

- What is gator lending in real estate?

- How the gator lending method works (2026 examples)

- Is gator lending legal?

- Pros and cons of gator lending in 2026

- How to protect yourself when using gator lending

- Who should use gator lending in 2026?

- How CRE investors can succeed with gator lending in 2026

- How to get started with gator lending

Want to see how safe gator lending works? Contact Duckfund to find out how our fast, flexible financing can secure your next deal in 48 hours.

What is gator lending in real estate?

In simple terms, gator lending in real estate is a flexible, fast form of private financing that helps investors secure or control a property when traditional lending is too slow, too restrictive, or simply unavailable.

In 2026, the concept has matured into an umbrella category that includes several types of finance, including:

- Earnest money deposit (EMD) financing

- Same-day transactional funding

- Short-term gap loans

- Partnership-style equity injections for commercial deals.

The idea traces back to real estate educator Pace Morby, who popularized the “Gator Method” as a creative workaround for investors struggling to access capital. Over time, his framework has expanded from “Gator 2.0” to “Gator 4.0,” with each version expanding its scope, from simple EMD assistance to community-driven private lending models.

While the strategy began in residential wholesaling circles, CRE investors and developers now use gator lenders to:

- Secure competitive properties with fast EMD

- Execute double closings in assignment-restricted states

- Fund quick-turn value-add deals, known as flipping commercial real estate

- Bridge liquidity gaps between acquisitions, renovations, and resale

- Move on multiple deals simultaneously without tying up cash.

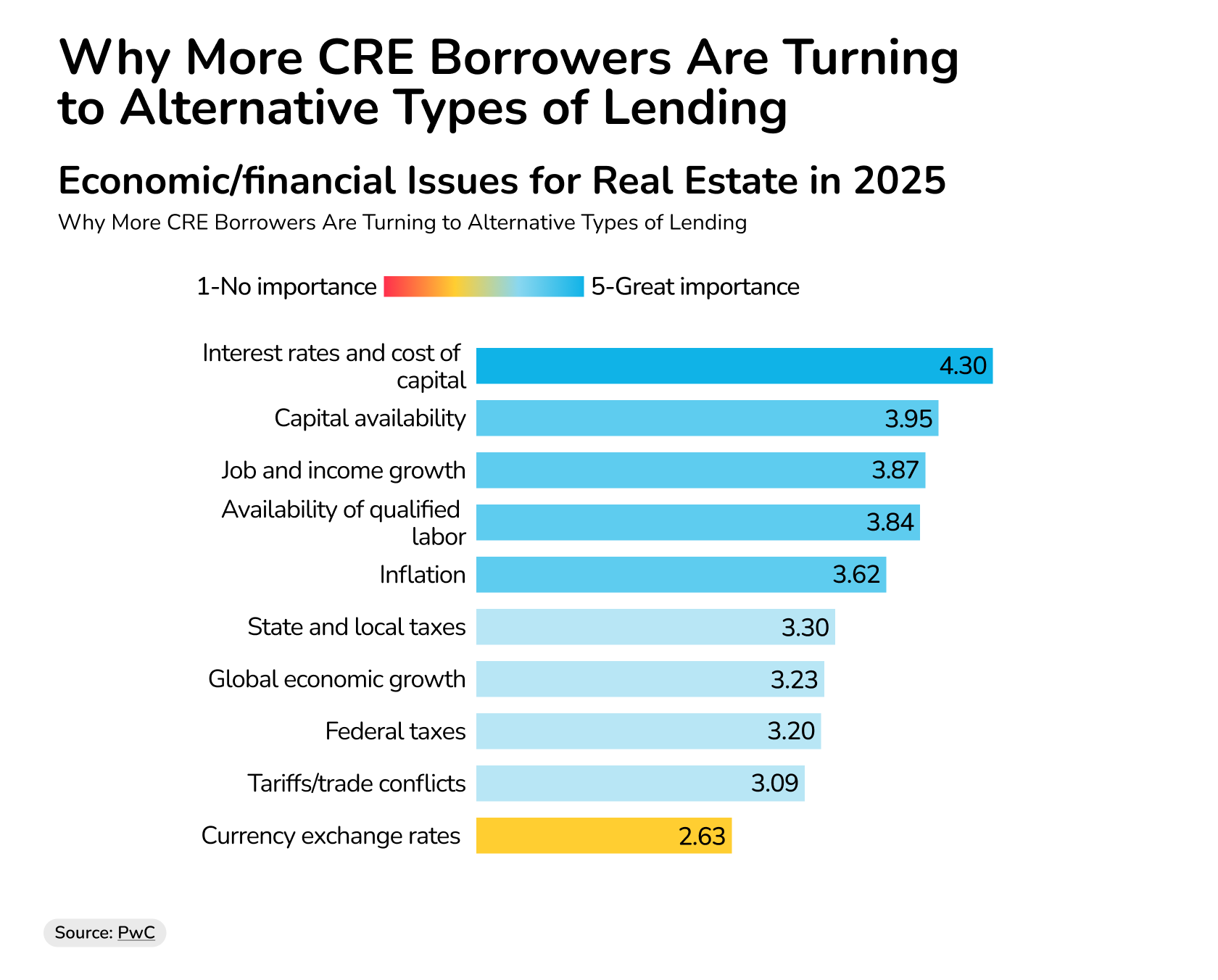

Tightening credit and a higher cost of lending, shown as the two most pressing issues in the PwC data below, are pushing investors to use gator lending as we enter 2026.

Source: PwC

What is a gator lender?

A gator lender is any private individual, funding network, or fintech platform that provides short-term, high-speed capital to help an investor secure a deal.

Some specialize in EMD financing, while others offer flash funding, gap funding, or equity-based partnerships. The common thread between all of these includes:

- Speed

- Flexibility

- Low documentation

- Short repayment cycles

- Deal-by-deal decision-making

In today’s CRE environment, gator lenders effectively act as the “first capital in” when timing is tight and traditional lenders can’t move quickly enough.

How the Gator Lending method works (2026 examples)

The gator method is built for one thing: speed.

When you can’t wait for a bank, and you don’t want to lose a deal over an earnest money deposit or slow underwriting, gator lending gives you a fast, flexible path forward.

It’s a creative financing approach that lets real estate investors move on opportunities even when their own cash is tied up.

There’s no single formula. Some investors use it as gap funding for short-term deals. Others treat it like transactional funding, where they borrow money for a same-day or two-day close, and in competitive CRE markets, many rely on it simply to stay ahead of other buyers.

Below are the clearest examples of how the gator method works in practice today.

Example 1: Transactional funding for wholesalers and double closings

In markets where assignment isn’t allowed, wholesalers still need a way to close the A-to-B and B-to-C transactions. Traditional lenders avoid this because the loan duration is too short.

Gator lenders don’t care about the timeline. They care about the exit.

Here’s how it works:

- You already have a buyer lined up.

- The gator lender fronts the purchase price for a few hours or a day.

- You close the resale immediately and repay the loan.

This financing option gives wholesalers a fast, legitimate way to work within state rules, without needing their own money at closing.

Example 2: Short-term gap funding for fix-and-flip deals

Flippers often run into timing issues, like renovations dragging, closing costs shifting, or maybe cash flow gets tight between projects. CRE hard money lenders don’t always bridge those gaps, and interest rates can be painful.

Gator lenders step in with a short-term loan. It fills the space between acquisition and resale, with no long-term commitment and no complicated underwriting.

Real estate investing professionals use it to cover:

- Light rehab

- Holding costs

- Small-scale value-add work

- Final repairs to list the property faster

It’s not meant to fund the whole deal, just the part that keeps the project moving.

What is the gator method in flipping houses?

Originally, the Gator Method became popular among flippers who needed quick capital to close a purchase, cover repairs, or push a deal across the finish line. Instead of using their own money or waiting for CRE hard money lenders, they pooled resources from private lenders and community networks like Subto.

The core idea hasn’t changed: Move fast. Don’t lose a deal because of liquidity. Protect yourself with due diligence and clear exit plans.

But in 2026, the strategy has evolved far beyond residential flips. Now it’s a mainstream financing strategy across the world of real estate, especially in CRE, where timelines are tight and every day of delay puts a deal at risk.

Example 3: Equity partnerships for bigger CRE opportunities

In 2026, more investors are using the Gator Method to form strategic partnerships instead of taking on debt.

A gator lender puts in a portion of the capital, sometimes 10%, sometimes 50%, in exchange for equity or a share of the rental income.

This appeals to both sides:

- Investors get fast access to money.

- Lenders earn returns without managing an asset.

- This is becoming common for distressed properties, value-add deals, and small-to-mid-sized CRE acquisitions where speed and flexibility matter more than traditional loan structures.

Example 4: Fast earnest money to lock in a competitive deal

You find a solid investment property, but the seller wants EMD now, not in three days or after a bank review. This is where the gator method shines.

- A gator lender fronts the earnest money deposit upfront.

- You sign the purchase contract.

- The title company holds escrow.

- You keep control of the deal.

Once your longer-term financing comes through, you pay back the EMD and move forward.

Let’s take the example of a CRE investor that spots a strong $850K retail pad opportunity, but the seller requires a 5% EMD ($42,500) within 24 hours to accept the offer. The investor’s cash is tied up in another closing. A gator lender fronts the full EMD, sending funds directly to the title company.

The investor signs the contract, secures the deal, and keeps control of the asset while their bank finalizes long-term financing. Once the loan closes, they repay the EMD and move forward.

This type of fast-funded EMD support is the most common gator lending use case in 2026 – because it wins deals when timing decides everything.

Is gator lending legal?

Gator lending is legal when it’s structured correctly. It’s simply a form of private money used to move quickly on real estate deals.

Investors have always borrowed from private lenders, friends, partners, and community networks. The gator method just packaged that idea in a more organized way.

Where things get complicated is how the deal is structured. Some versions of gator lending fall under standard creative financing. Others look more like short-term loans, gap funding, or even micro-partnerships. Each version has different rules, risks, and requirements. This is where due diligence matters.

Pros and cons of gator lending in 2026

Gator lending wouldn’t be surging in popularity if it didn’t solve real problems for investors, but there are some possible pitfalls.

Let’s break down the pros and cons.

Pro #1: Speed

In 2026, gator lenders move faster than banks, private equity, or hard money lenders. When a seller wants an earnest money deposit within 24–48 hours, or when a distressed deal appears out of nowhere, this speed becomes a competitive edge.

Pro #2: Flexibility

Terms are shaped deal-by-deal, not by generic underwriting checklists. That flexibility lets investors keep momentum, especially when juggling multiple opportunities or when cash is momentarily locked up in another closing.

Pro #3: Fills capital gaps

Another benefit is the way gator lenders fill uncomfortable gaps in the capital stack.

A CRE investor might already have long-term financing lined up, but needs short-term liquidity to get a purchase contract signed now, not in two weeks. A wholesaler, too, may be forced into a double closing in a state where assignments are restricted.

A small injection of capital at the right time can create leverage far beyond its size. In a slow-moving lending environment, that leverage can determine who controls the deal.

But gator lending isn’t perfect – and 2026 has exposed its weak spots.

Con #1: Social media scams

As the method grows, so does the possibility of bad actors.

Social media is a potentially dangerous risk zone, especially for crooks targeting beginners who don’t know how creative financing is supposed to work.

Fake “private lenders” promise everything from overnight approvals to unbelievably low interest rates. Others ask investors to wire earnest money deposits to personal accounts or send cash through apps like Venmo – an immediate red flag in any real estate transaction.

Con #2: Higher costs

Even when everything is legitimate, gator lending can be expensive. Because these deals move fast and carry more risk for the lender, the financing fees or interest rates are often higher than traditional options. That’s the trade-off for speed.

For investors working with tight margins (especially in today’s CRE environment, where renovation costs, closing costs, and holding expenses keep rising), those fees can quickly eat into profits.

This becomes even more challenging for flippers and wholesalers who rely on small spreads to make a deal worthwhile. If the resale takes longer than expected, or if the rental income isn’t as strong in the early months, the cost of short-term capital can squeeze cash flow and limit your ability to move on to the next opportunity.

Gator lending works best when the exit is clear, quick, and predictable – if not, the cost can outweigh the benefit.

How to protect yourself when using gator lending

Fortunately, protecting yourself isn’t complicated.

You can start during the negotiation process. If a lender won’t provide a simple written agreement outlining repayment terms, fees, and responsibilities, walk away. If they refuse to send funds through a title company, or if they pressure you to skip due diligence because “the deal is hot,” walk away even faster.

In 2026, urgency is used as a weapon by scammers just as often as it's used by real sellers.

For the actual deals, start by keeping every transfer tied to a reputable title company. Escrow protects both sides, and it makes sure the property, seller, and timeline are real.

Put all agreements in writing, including loan terms, fees, repayment windows, and what happens if the deal falls through. Clear expectations reduce the risk of disputes and eliminate the ambiguity that scammers rely on.

Most importantly: work with structured providers or vetted networks. Specialized platforms (like Duckfund) operate with transparent processes, proper entity formation, and funds that move through escrow rather than personal channels.

You know exactly who you’re dealing with, where the money is going, and what happens next. In a market filled with noise, that structure is worth more than speed alone.

For investors, the payoff is simple: gator lending can be a powerful tool in 2026, but only when executed with the same discipline you’d use for any other part of a deal.

Done right, it’s a shortcut to controlling opportunities. Done wrong, it’s a shortcut to losing capital before you even start.

Who should use gator lending in 2026?

Gator lending 2026 fits several types of CRE investors – the one thing they all have in common is the need to act fast and stay flexible.

CRE developers, for example, often need immediate control of a site before competitors move in. A quick earnest money injection lets them secure the contract while they finalize their long-term financing.

Wholesalers working in assignment-restricted states also rely on gator lending to complete double closings without slowing down their deal flow. It gives them a clean, compliant path forward without risking contractual issues.

Then you have investors who are temporarily low on liquidity. These may have strong portfolios and solid financing, but have all their cash tied up in another transaction. Instead of missing out, they use gator capital to bridge the gap.

It’s also ideal for repeat buyers juggling multiple deals at once and out-of-state investors who simply can’t wire 5–10% EMD on short notice due to banking cutoffs, time zone differences, or transfer limits.

Gator lending gives them the speed of a local buyer, even from across the country.

How CRE investors can succeed with gator lending in 2026

Success with gator lending is all about clarity and timing.

The strongest investors treat it as a precision tool, above anything else. They know exactly when they need fast capital, how long they’ll need it for, and what gets the lender repaid. That clarity keeps deals clean and prevents last-minute surprises.

Strong communication also matters. Sellers, title companies, and lenders move smoothly when everyone understands the timeline up front. Investors who share their closing plan early usually face fewer delays and avoid the kind of confusion that derails tight-deadline deals.

Another key factor is pairing gator lending with a solid exit strategy. Investors who plan ahead reduce holding risks and keep costs in check.

“You should clearly explain your exit strategy (to the lender),” says James Nelson, head of Avison Young’s Tri-State Investment Sales group. “Are you planning to hold long-term and refinance, or sell in five years?

In 2026’s fast-moving CRE market, the investors who win aren’t the ones who move the fastest – they’re the ones who move fast and predictably.

Gator lending and earnest money financing (2026 Update)

Earnest money financing will quietly become the most reliable expression of the Gator Method in 2026.

With higher EMD expectations in competitive CRE markets, investors typically need 5–10% on hand immediately just to stay in the running, and they’re almost always a requirement. “It's seldom that you see a transaction where earnest money isn't on the table,” says Deonte Cole, a real estate agent at Keller Williams Realty, speaking to Business Insider.

That’s where gator lending shines: it gives investors the ability to secure the contract now and sort out the rest of the capital stack later.

Platforms like Duckfund have refined this into a streamlined process that fits modern CRE deal flow. Investors can request EMD funding in minutes, get approval without extensive credit checks, and move money through escrow in as little as 48 hours.

This removes the single biggest early-stage bottleneck in commercial real estate: having enough cash at exactly the right moment.

In a market where timing determines who controls the deal, earnest money financing done well can be the difference between watching a deal slip away and locking it in before anyone else has a chance.

Don’t let a lack of finance cause you to miss out on your next deal. Sign up for Duckfund and unlock fast, flexible funding in minutes.

Real Estate

Financing

- Approval within 24 hours

- Fund multiple properties at once

- No full deposit upfront — soft deposit only

- Apply in under 2 minutes

Secure your next development — zero upfront capital required.

Start with Duckfund’s Sign Now, Pay Later model.- No capital commitment

- Close faster

- Scale with confidence