How Much Earnest Money Is Required in Georgia? (And Other FAQs, Explained)

Understanding how much earnest money is required in Georgia, when and how to pay, and who holds the earnest money are all vital to closing a successful property sale in one of the US’ top markets.

For investors and buyers interested in Atlanta, one of the top real estate markets in the United States and home to Fortune 500 companies, such as The Coca-Cola Company and The Home Depot, finding out how much earnest money is required in Georgia is crucial to sealing the deal on a hot Georgia real estate property transaction.

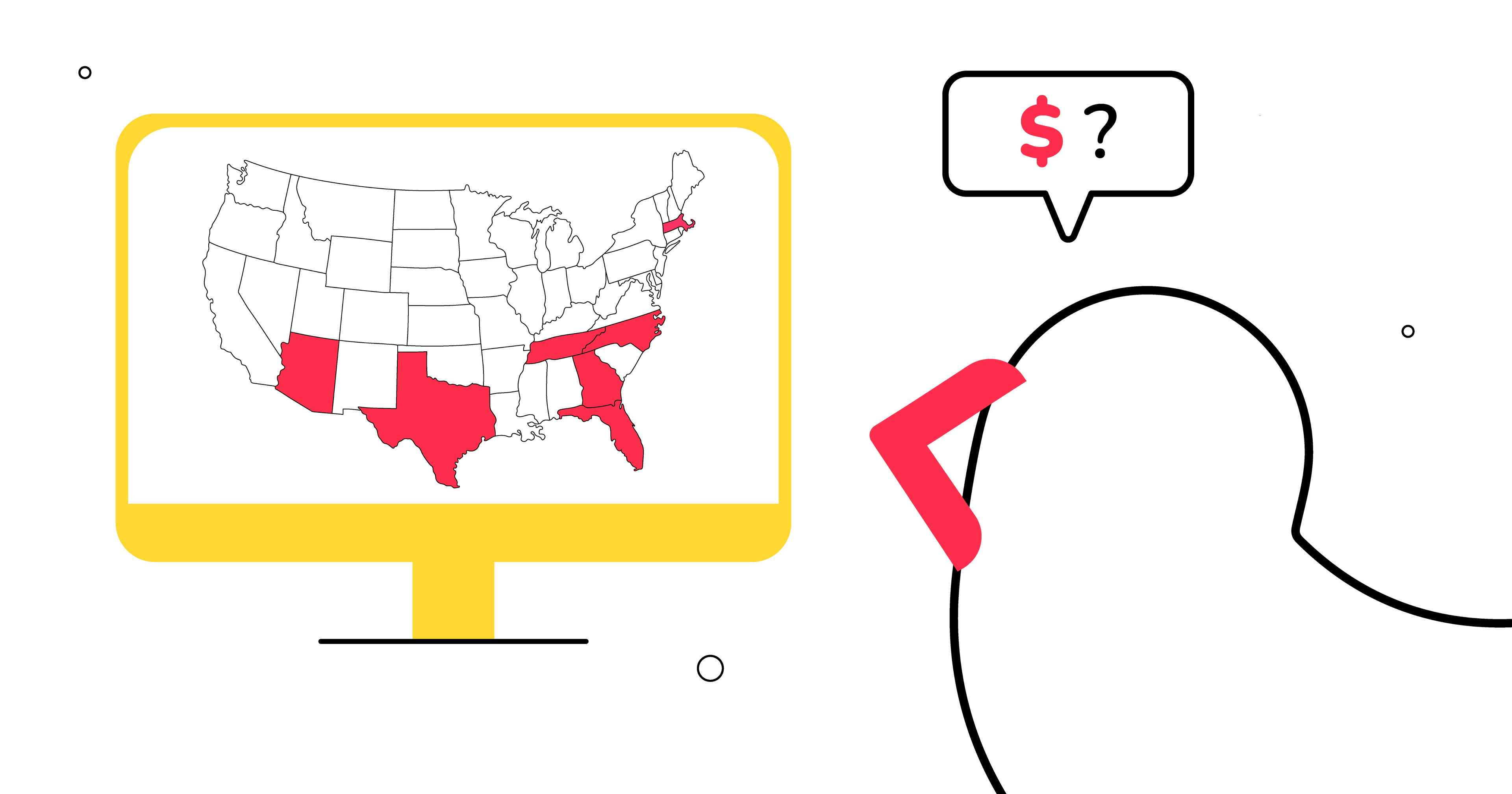

Nashville, Tennessee; Dallas/Fort Worth, Texas; and Atlanta, Georgia are the top three real estate markets in the US

Georgia has much to offer to prospective buyers and investors in its capital, Atlanta, which has grown into a bustling hub for technology, finance, and healthcare industries. As a result of this expansion, the demand for more housing, office, and commercial spaces has soared.

Atlanta’s strong economy is one of the most productive contributors to the country’s annual GDP; its population is growing; it’s easily accessible by road, rail, and air; the cost of living in Atlanta is relatively lower than other major US cities; and the state’s arts and culture scene is diverse and vibrant.

Downtown Atlanta, Georgia

Atlanta is not the only city giving Georgia a fantastic reputation in real estate. Savannah’s economy is thriving, thanks to a variety of industries including manufacturing, tourism, and logistics, and its rental market is strong. Additionally, the city currently has the highest amount of ongoing construction—auto giant Hyundai’s Metaplant construction is underway in the city’s outskirts—and has climbed to the third spot in terms of most square feet in development in the US.

Downtown Savannah, Georgia

Tourism is also a large draw for visitors to The Peach State—some of the best things to do in Georgia include visiting the South’s most iconic cities; traversing quaint towns and soaking up their historic charm; participating in vibrant cultural festivals; and exploring mountains, waterfalls, and gorgeous natural landscapes and vistas.

Investing in a hot real estate market like Georgia is certainly an attractive option for buyers looking for a good return on investment, and understanding how much earnest money is required in Georgia is key to making a great sale happen, keeping both buyers and sellers satisfied.

We are here to guide you through the ins and outs of earnest money in Georgia—we’ll address how much earnest money is required in Georgia as well as other common earnest money-related concerns you might have.

To assist you in navigating the process of earnest money in Georgia, we’ve prepared this thorough guide, which will answer the following questions:

- What is the role of earnest money in a real estate transaction?

- Who holds the earnest money in Georgia?

- How is earnest money different from down payments and option fees?

- Is it a requirement to pay earnest money in Georgia?

- How much earnest money is required in Georgia?

- When should earnest money be paid in Georgia?

- How should earnest money be paid in Georgia?

- Is earnest money in Georgia refundable?

- What are some examples of situations when a sale falls through, and who keeps the earnest money in those cases?

- How can earnest money in Georgia be protected?

[Exploring potential CRE investment opportunities in Georgia but struggling with the upfront earnest money deposit? Sign up for Duckfund now and access budget-friendly and adaptable soft deposit financing options designed to align with your needs—all in just 48 hours!]

How much earnest money is required in Georgia?

1. What is the role of earnest money in a real estate transaction?

Earnest money, also referred to as a soft deposit or good faith money, is a sum that buyers submit before a property's closing date to demonstrate their commitment to the sale. Similar to mortgage pre-approval, paying earnest money in Georgia signifies a buyer's seriousness and intent to proceed with the sale and gives the seller assurance that the transaction will go through, establishing trust between both parties.

If the buyer doesn't finalize the purchase and the deal falls through, the seller can retain the earnest money for their efforts or refund it to the buyer, depending on agreed contingencies in the contract. Conversely, in a successful sale, the earnest money contributes to the purchase price or covers closing costs.

2. Who holds the earnest money in Georgia?

Earnest money deposits in most of the United States are held in an escrow account, a legal arrangement in which a third party temporarily holds property or money until certain conditions are fulfilled until the sale is completed. It can then either be applied to the buyer's closing costs or refunded if the buyer backs out of the transaction for reasons stated in the purchase and sale agreement.

In Georgia, things are done a little differently. US international real estate company Remax Around Atlanta says that the holder of the earnest money is “up for negotiation.”

In the Atlanta market, “the buyer’s broker generally holds the earnest money, but “in other markets, like Savannah, it is the opposite”—the seller’s broker acts as the earnest money holder.

Remax also notes that “there is also a trend to the closing attorney holding the funds, as attorneys are generally seen as neutral third parties.”

Bill Golden, a realtor and associate broker at Keller Williams Realty Intown Atlanta, says that in Georgia, “the earnest money is held by one of the real estate brokers in the transaction, or sometimes by an attorney.”

3. How is earnest money different from down payments and option fees?

Let’s clear the air on the differences between earnest money, down payments, option fees, which all play a part in the purchase of a new home or commercial real estate property in Georgia but serve different purposes.

Option fees, sometimes called inspection fees, is a non-refundable payment that can be applied to the final sale price of the property after closing. This payment (around $100-$300 in Georgia, depending on the property’s purchase price) gives the buyer access to the property during an option period, normally between seven to 10 days, during which they can conduct building and home inspections. These can range from termite inspections to neighborhood checks.

Paying the option fee gives potential buyers the right to terminate the contract before the option period is over.

A down payment is a portion of a property’s purchase price, which the lender demands from the borrower only in mortgage transactions and not when the buyer is paying in cash. A down payment acts as assurance to the lender that the borrower will be able to pay their regular mortgage fees, helps the lender to reduce risk, and gives the borrower better loan terms.

4. Is it a requirement to pay earnest money in Georgia?

While it's not legally required, earnest money is expected when sealing the deal on a home buy or a proper real estate agreement in Georgia. Most real estate brokers, attorneys, real estate agents, and loan pros will encourage buyers to put down some earnest money to prove their commitment to the sale.

5. How much earnest money is required in Georgia?

In terms of how much earnest money is required in Georgia, One Closing Source notes that “typically, earnest money checks are between 1 to 3% of the house’s price,” depending on the pace of current CRE or housing market conditions as well as local custom. On the median price of $400,000 on a home in Atlanta, for example, 1 to 3% would be $4,000 to $12,000 in earnest money deposits.

Potential buyers would do well to note that how much earnest money is required in Georgia depends on how serious they are about the sale as well as the demands of the market.

Mike Schneider, a realtor at Georgia Home Match, comments that “a higher deposit can be required if there is a lot of demand in the local market, but on the other hand, a low deposit might be accepted if there isn’t much demand.”

Schneider also adds that “in some cases, a higher deposit will lead to an offer being accepted” and “could also lead to the seller being more flexible on other terms in the offer.”

In faster-moving markets, earnest money deposits can go as high as 10%.

6. When should earnest money be paid in Georgia?

In Georgia, earnest money should be paid after both buyer and seller have signed the purchase agreement, which will specify the exact amount of earnest money required and the deadline for the payment.

Schneider notes that the funds should be “readily available” for you to wire to the agreed upon holder of the earnest money “sometimes within three days of a binding contract.”

Golden says that “in most cases, you’ll need to deposit the earnest money within a day or two after your offer is accepted.”

Schneider adds some important advice for preparing your earnest money deposits—”Plan for earnest money well in advance of submitting an offer on a property… If you need to withdraw money from a 401 or similar retirement account, this could take weeks.”

When calculating the earnest money due date, it’s important to remember that 1) weekends and holidays are included in the official day count and 2) the deadline is extended to the next business day when the earnest money due date falls on a legal holiday or weekend.

7. How should earnest money be paid in Georgia?

Besides knowing how much earnest money is required in Georgia, it’s crucial to be aware of the different payment methods available to commercial real estate buyers and developers. In some states, like Colorado, cash is no longer accepted as a form of earnest money payment.

According to Peoples Company, who have offices in Georgia, "earnest money payments can be provided in the form of cash, check, ACH [Automated Clearing House transfer], or wire transfer, per acceptance of the seller.”

“Copies of the earnest money deposit should be provided to both the buyer and seller,” says Peoples Company, a real estate firm, adding that “earnest money is deposited into a trust account determined by the seller, or as agreed upon by the seller and the buyer.”

8. Is earnest money in Georgia refundable?

Yes, earnest money in Georgia can be refunded.

If a sale doesn’t go through for a certain reason, the earnest money can go two ways—either the seller holds onto it or it is refunded back to the buyer. This is dependent on what is written in the sale contract. If the seller changes their mind or reneges on the contract in any way, the buyer usually gets their money back. But if the buyer changes their mind, the seller gets to keep the earnest money.

9. What are some examples of situations when a sale falls through, and who keeps the earnest money in those cases?

- Buyer or seller defaults on the contract: If either the buyer or the seller fails to comply with terms specified in the contract, the other party has the right to terminate the contract and keep the earnest money.

- Issues with the title: The buyer has the right to object to and contest issues to do with the title and other documents, and the seller has 15 days to deal with and fix the issue. If the seller fails to sort out the objections within the time period, the contract is terminated and the earnest money is then refunded to the buyer.

- Buyer backs out during option period: If the buyer paid an option fee to inspect the property prior to purchase, this gives them the right to back out of the contract within the option period and for any reason. In this case, the seller keeps the option fee and the earnest money is returned to the buyer.

- Repairs mandated by lender: If the lender demands repairs on the property, neither the seller or the buyer is required to pay for them, and either party can cancel the contract. The earnest money is then refunded to the buyer.

- Seller fails to complete agreed-upon repairs: If both the seller and the buyer agree on repairs, the seller is required to complete all repairs (and ensure that they are done by licensed contractors with appropriate state-issued permits). If they fail to do so, the buyer has a few options: they can extend the contract’s closing date or end the contract and get their earnest money deposit back.

- Buyer’s financing does not go through: For contracts with a financing contingency, buyers can have their earnest money refunded if financing falls through. If the buyer chose to waive the contingency and their commercial or home loan does not go through, the earnest money is then forfeited to the seller.

There are a number of obstacles that could impede the sale process, which can lead to earnest money disagreements. Having seasoned real estate lawyers on your side is crucial to keeping things on track and making sure all parties are protected.

10. How can earnest money in Georgia be protected?

There are several ways that prospective buyers can protect their earnest money deposits:

- Include financing, appraisals, and inspections contingencies in the purchase contract: Without proper contingencies written into in the contract, the seller gets to keep the earnest money if the buyer can't get financing

- Ensure contract terms (and all amendments) are in writing: The contract agreement, as well as any amendments between a buyer and seller, must be in writing and must be signed by both parties to be considered valid. It’s best to work with real estate lawyers who can advise on the process and take care of all the legalities.

- Understand and strictly follow the terms of the contract: The buyer should ensure that they read, comprehend, and abide by the terms of the contract. Failure to do so could result in forfeiting the earnest money deposit to the seller.

- Put the earnest money in an escrow account and get receipts: Earnest money is never paid directly to the seller but instead should be paid to an escrow firm who can hold and safeguard the funds until the transaction is complete or terminated. The buyer should make sure that they have the appropriate receipt for their earnest money deposit. Both buyers and sellers must have copies of the earnest money receipts.

Again, it’s important to hire a real estate lawyer to help you through the legalities of the entire commercial real estate buying process. Interested commercial real estate developers and investors can contact the Georgia Real Estate Commission for further guidance.

Being as informed as possible on how much earnest money is required in Georgia, along with the other steps and nuances of the earnest money process, is key to a smooth, successful real estate sale in one of the US’ hottest markets.

[Expand your commercial real estate portfolio with Duckfund, which lets you access low-cost, flexible, and fast soft deposit financing solutions easily and quickly, with high approval rates, low-interest rates, and easy applications. Sign up today!]

Real Estate

Financing

- Approval within 24 hours

- Fund multiple properties at once

- No full deposit upfront — soft deposit only

- Apply in under 2 minutes

Secure your next development — zero upfront capital required.

Start with Duckfund’s Sign Now, Pay Later model.- No capital commitment

- Close faster

- Scale with confidence