The Capital Conundrum: How to Raise Capital for Commercial Real Estate in 2026

There’s no CRE success without capital or cash – every developer knows that. But how to raise capital for commercial real estate in today’s market, very few seem to know.

That’s because the economic and financial landscape shifted hard in 2025. The trump administration rocked markets while lenders carefully opened their wallets again after two years of drought. But money lenders are pickier than before.

At the same time, good real estate deals are moving fast — properties you spotted last week get snatched up by accredited investors who figured out their funding before you did.

Here's what's keeping most commercial real estate investors from fundraising right now:

- Slow traditional financing can’t keep up while private money picks up the best investment opportunities

- Banks require strong underwriting and turn down potential investors with limited track record or investment capital

- Capital sources are scattered and one-stop solutions are hard to find in commercial real estate investing

Want to overcome these hurdles and raise funds for real estate projects in 2026? This guide offers fresh insights into what has changed in the capital markets since 2024, before breaking down four smart strategies on how to raise capital for commercial real estate in today’s market.

Read on for the ins and outs of raising capital for real estate investment.

[Want to move quickly on CRE opportunities without disrupting your cash flow? Sign up now for flexible soft deposit financing options designed for today's market — with approval in just 48 hours.]

The 2026 capital landscape: What's changed since 2024

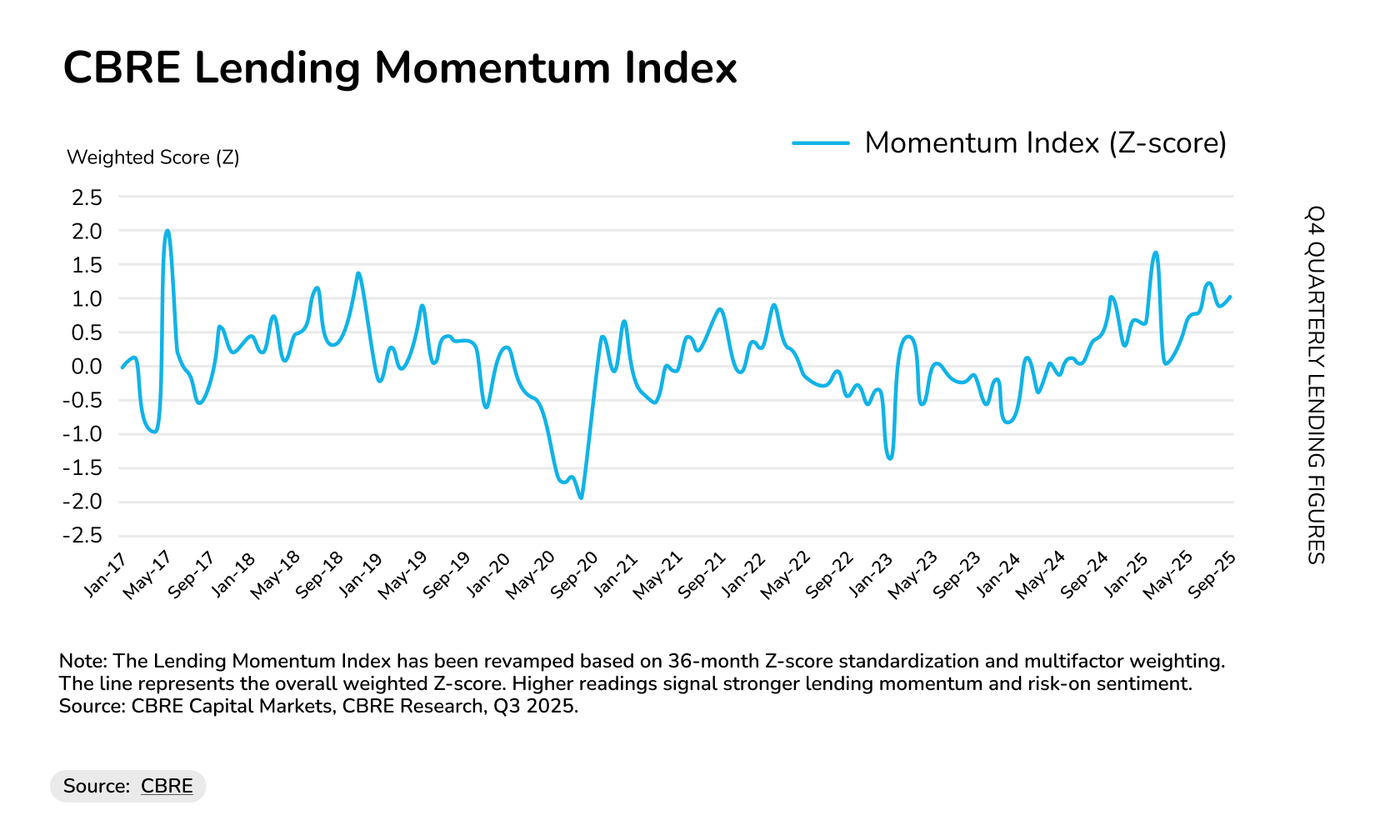

Good news: the markets are looking promising for capital raising in 2026.Commercial real estate lending surged in Q3 of 2025, with the CBRE Lending Momentum Index surging 112% year-over-year to 1.04. CRE investment volume increased by 13% year-over-year to $112 billion.

Source: CBRE

So what drove this momentum? In a nutshell, borrowing costs stabilized and tighter credit spreads helped bridge pricing gaps between buyers and sellers.

Commercial mortgage interest rates dropped 28 basis points quarter-over-quarter, the CBRE reported. As a result, boosting real estate deal activity across asset classes. CMBS issuance reached $115.2 billion through November 2025, according to credit agency KBRA – the highest volume since 2007.

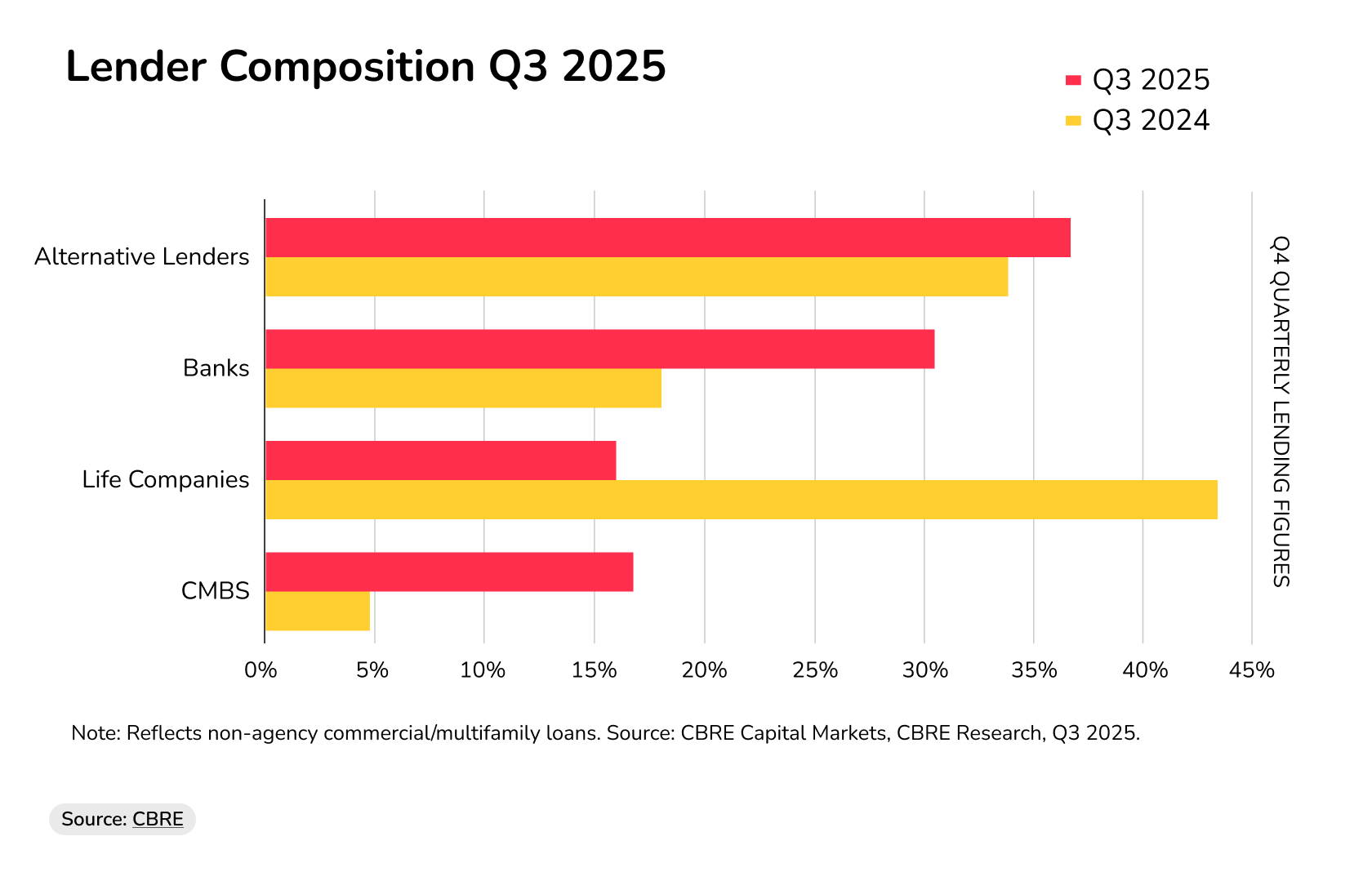

Remarkably, alternative lenders were the biggest non-agency lenders, up from 34% last year to 37%, followed by banks (31%) and life companies (16%). That’s a significant change from Q3 of 2024, when life companies were by far the biggest lenders.

Source: CBRE

Alternative lenders now control the market, with debt fund volumes driving the increase through a 68% Y-o-Y rise. Banks made a big comeback too — their originations jumped 167% year-over-year — but they're no longer the dominant force they were pre-pandemic.

Michelle Herrick, Head of Commercial Real Estate at J.P. Morgan, captures the 2026 sentiment: “All capital sources are firing, and borrowers across the lending spectrum are able to refinance or secure all types of debt capital for either acquisitions or construction in a much easier fashion than had been the case in recent years.”

But how much easier can new investors access capital? Because CBRE data shows that lenders remain selective. The average LTV ratio increased from 63.3% in Q2 to 63.8% in Q3 as borrowers assume more debt, reflecting only a mild easing of the conservative lending environment.

The capital is there, but lenders aren’t throwing money at weak deals. For commercial real estate professionals, knowing what capital sources to use for what deals remains crucial knowledge in 2026 – especially now that the lender composition has changed.

That's why knowing how to raise capital for commercial real estate across multiple sources matters more than ever. Relying on a single lender type in 2026 means losing deals to competitors with diversified capital stacks.

4 smart ways to raise capital for commercial real estate in 2026

Now that we understand the market context, which funding sources can help you close deals in today’s CRE market? And importantly, how to raise money for real estate fast?

The smartest investors don't rely on one capital channel to fund commercial real estate deals. They stack multiple sources — senior debt from banks, mezzanine layers from private funds, equity from syndicates — to build capital structures that maximize leverage while keeping cash on hand for the next opportunity.

Some require years of track record and a watertight business plan, while others work for new investors. It’s up to the individual investor to match capital sources to their CRE project. Below are four strategies that work in today’s market:

1. Private equity partnerships

Private equity remains the bread and butter of CRE funding. In real estate, equity investors are people who become shareholders in the property in proportion to the amount they contributed towards its purchase. With stocks, shareholders are rewarded with either dividends or capital appreciation.

The same thing applies in the CRE market. Equity investors will have a share of net profit (rent minus maintenance costs) according to the number of shares they hold.

Also, when there is a property sale, the net receipts will be distributed according to the number of shares held.

As an investor, your ability to secure equity investors often depends on the strength and value of your personal and professional networks. Some of them may be fellow real estate investors, institutional investors, or even friends and family members.

How to raise equity for real estate?

- Find the deal before you find the money: This was the advice of Caleb Hommel and Chuck Sotelo, two investors who started their real estate investment journey without their own money, in an interview with the Business Insider, to those trying to raise private capital.

“The deal always comes first,” they said. If you can find good deals to present to potential equity investors, finding investors becomes “a lot easier.”

- Build strong networks: One of the emphases of Pace Morby’s gator lending is the importance of building relationships and participating in communities (whether offline or on social media). When investors are active in their communities, it becomes easier for them to access creative financing.

- Do a market analysis: Are there similar deals that have been completed in the community of interest? Find out those who invested in those deals and find a way to pitch them your deal.

- Don’t ignore institutional investors: If you have a link to institutional investors, consider exploring it. Some of them may be looking to expand the real estate portion of their portfolio.

A market analysis is also needed here to identify which institutional investors have an interest in what type of real estate, because institutional money has turned its attention on a certain CRE asset.

2. Institutional capital and LP-GP arrangements

Institutional money returned to CRE in 2025 – but it’s data centers that attract all the capital, according to the Urban Land Institute and PwC's Emerging Trends in Real Estate 2026 report.

Deloitte ranks digital-economy properties — data centers and telecom towers— as the #1 opportunity for 2026, showing institutional capital's driving force in commercial real estate digital transformation.

“It was a crazy 2024, and then there was this little slowdown, and it’s just like floodgates opening in Q3 of this year,” Phoebe Bernet, who is an associate at CBRE, said. “Nationally, it’s been the largest leasing quarter ever in the history of the data center market.

How to get investors for real estate development in data centers? By attracting institutional capital through a GP-LP deal. In general partner-limited partner arrangements, LPs provide 80-95% of equity capital while GPs contribute just 5-20%, according to industry standards. The GP handles deal sourcing, underwriting, asset management, and investor relations. The LP gets passive exposure without operational headaches.

Here’s what institutional LPS demand in 2026:

- Proven sponsorship – First-time sponsors struggle to attract institutional capital. You need a track record showing successful exits, ideally with audited financials from previous funds.

- Deal size minimums – Most institutional players won't consider deals under $50 million. They'd rather write one $100 million check than ten $10 million checks.

- Strong expertise – With CRE firm JLL projecting nearly 100 GW of new data center capacity requiring $3 trillion in investment by 2030, institutional investors will only back viable projects backed by credible companies.

If you're chasing large-scale commercial property opportunities — especially data centers and logistics hubs — this is how to raise private equity for real estate at scale.

3. Real estate syndication

Syndication remains the go-to strategy for deals between $5 million and $50 million — too large for individual investors, too small for institutional funds.

A real estate syndicate is a group of people who combine resources to invest in real estate properties. Members of real estate syndicates are equity investors. In a syndication, the sponsor (or syndicator) identifies the property, structures the financing, and manages operations while limited partners contribute capital for passive equity stakes.

The mechanics haven't changed much since 2024, but investor expectations have. Recent tighter lending standards pushed up minimum investment amounts, according to the lending group Gateway Private Equity, with most syndications now requiring $50,000 to $250,000 per investor rather than the $25,000-$50,000 minimums common two years ago.

Lenders want bigger equity cushions, and sponsors need more capital to offset higher borrowing costs.

How to raise equity for commercial real estate through syndication? Here’s what you should pay attention to in 2026:

- Align on realistic internal rate of return (IRR) targets – Value-add deals typically target 8-12% IRRs in 2026, Gateway PE reported, down from the 15%+ projections common in low-rate years. Core-plus strategies generating steady cash flow attract conservative LPs who prioritize distributions over upside.

- Prepare a bulletproof private placement memorandum (PPM) – Your offering memorandum must address 2026 refinancing risks head-on. Don't hide behind optimistic assumptions – investors expect conservative underwriting after watching sponsors miss projections in 2023-2024

- Show track record with transparency – LPs want to see how you performed during the 2023-2024 slowdown. If previous deals underperformed, explain what changed in your approach.

- Find the right partners – Syndication works best when you've got a trusted partner with a network ready to deploy capital quickly. As Anna Kogan, CEO of Duckfund, told Commercial Observer: "We help to put the deal under contract and then we kind of hold their hand in the equity syndication process as well through our chains of trust of our partners."

Setting realistic targets, being transparent, and having trustworthy partners are crucial components for closing a syndication deal.

4. Alternative financing and soft deposit solutions

Traditional equity and debt strategies only work if you can get properties under contract first. But how to raise capital for real estate if the competition is forcing you to pay a deposit upfront? That's where most investors hit a wall in 2026's competitive market.

Different from down payments, earnest money deposits (EMDs) — also called good faith deposits — demonstrate a buyer's commitment and secure the deal while you line up financing. These deposits typically range from 1% to 3% of the purchase price, but hot markets see requirements of 5%, 10%, or even 15% for strong investment opportunities.

But tying up capital in earnest money for multiple deals drains liquidity fast. If you're pursuing three $10 million properties simultaneously, you've easily locked $1 million before closing a single transaction.

That’s a big reason why alternative lenders like Duckfund are dominating the lending market in 2026. These lenders focus on speed and flexibility rather than rigid credit standards or, making them ideal for time-sensitive opportunities demanding fast EMDs.

Soft deposit financing lets you put properties under contract without disrupting your liquidity. Duckfund's Sign Now Pay Later model allows investors to make multiple offers simultaneously, dramatically increasing the probability of winning competitive bids.

Duckfund provides approval within 48 hours with minimal requirements, keeping your capital intact for closing costs, renovations, or the next opportunity.

"We help to put the deal under contract and then we kind of hold their hand in the equity syndication process as well through our chains of trust of our partners," Kogan explained. The strategy works: secure the property first with soft deposit financing, then raise equity or debt using the strategies above while the earnest money period runs.

How to raise capital for commercial real estate and seal the deal before the competition

The four strategies above show how to raise capital for commercial real estate in 2026, from institutional partnerships demanding $50M+ commitments to syndications pooling retail investors for mid-market plays.

Alternative lenders captured 37% of the market in 2025, proving that diversified capital stacks win deals while single-source strategies leave you watching competitors close.

That's where soft deposit financing changes the way smart investors approach CRE dealmaking. While competitors tie up liquidity chasing one deal, you're pursuing five simultaneously. Duckfund's 48-hour approval process keeps your capital free for closings, renovations, and the next opportunity — not locked in earnest money waiting on sellers.

So how to raise capital for commercial real estate? By building a smart capital stack and relying on speed. The 2026 market rewards prepared investors who understand how to raise capital for commercial real estate before opportunities vanish.

[Your next deal won't wait. Neither should you. Join 4,000+ CRE investors who've secured over $1.5 billion in deals with Duckfund's Sign Now, Pay Later model. Get 48-hour approval, zero upfront capital, and discounted rates starting month four.]

Real Estate

Financing

- Approval within 24 hours

- Fund multiple properties at once

- No full deposit upfront — soft deposit only

- Apply in under 2 minutes

Secure your next development — zero upfront capital required.

Start with Duckfund’s Sign Now, Pay Later model.- No capital commitment

- Close faster

- Scale with confidence